Bolster the battle against chargebacks

Fraud is a costly and ever-growing battle for merchants. Every euro, dollar or pound of fraud now costs merchants more than three times as much in associated fees and indirect costs. Unfortunately, the cost of fraud for online merchants is often higher still.

Proactive fraud prevention is, of course, vital. But there will always be a certain level of fraud that slips through the net, and merchants need to do whatever they can to reduce the financial impact. A huge part of this challenge is handling chargebacks. It’s an expensive and resource-hungry process that can cost merchants dearly in fees, scheme fines and even loss of their card processing rights, should high chargeback levels be left unchecked.

Stop chargebacks before they start

Our analysis suggests that around 89% of chargebacks are due to fraud. These transactions are usually flagged by the issuer and fed back as a fraud notification by the card scheme.

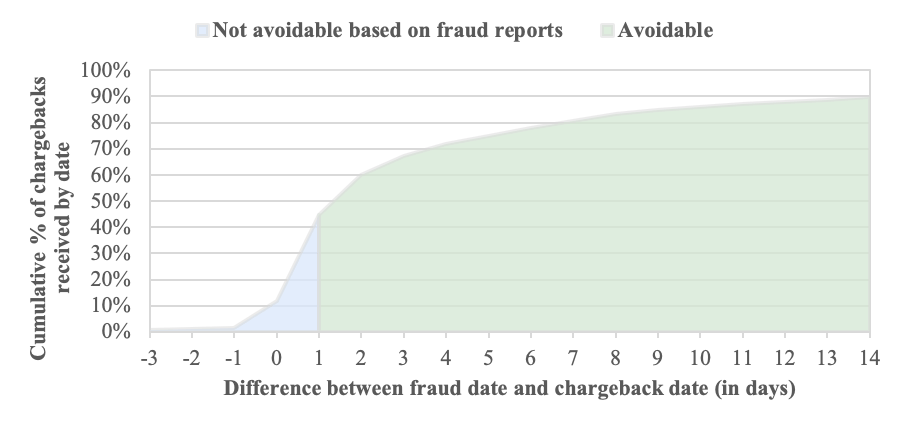

Usually, merchants receive a fraud notification around two days after the disputed transaction has gone through. Often, by this time, the defrauded customer has already initiated a chargeback and the merchant has lost the chance to prevent the process from being counted against their chargeback rates.

Difference between fraud date and chargeback date (in days)

Many of these chargebacks can, in fact, be avoided if the merchant’s acquirer is able to flag the fraudulent transaction and initiate a refund at an earlier stage – i.e. before the customer raises a chargeback. In summary, these chargebacks are avoidable. What’s more, according to our analysis, these avoidable chargebacks are a huge proportion of the chargeback volumes that merchants receive

Because acquirers receive fraud notifications at least a day earlier than merchants, these alerts can be used to refund confirmed fraudulent transactions en-masse which has a sizeable impact on preventing chargebacks, without much downside. The sooner the refund happens, the better the chance of preventing a chargeback.

Given how likely it is for a chargeback to happen following a fraud notification, it can save merchants significant costs in chargeback fees and resources to refund these transactions at the earliest possibility.

For example, take a small transaction worth 36 €, the merchant could be looking at a chargeback fee as high as 30 €, compared to a refund of just 1 €. It’s a clear commercial winner and helps to protect merchant reputation and relationships too.

We have already seen that using this proactive refund strategy, it is possible to reduce the chargeback volumes by up to 42%.

How TrustPay can help

We’re pleased to announce the full market launch of TrustPay’s new auto-refund tool designed to help merchants reduce their chargeback burden. The solution has been operational with a handful of our merchants for the last year. It has already delivered a 31% reduction in chargebacks for one merchant customer involved in the pilot programme.

The new auto-refund tool

The auto-refund tool delivers these benefits by proactively and automatically refunding a transaction which has been confirmed as fraud by the card scheme. Since we receive fraud notifications at least a day earlier than merchants, the auto-refund tool can power fast, automated action to be taken on day 1. This saves valuable time and means the customer doesn’t need even to initiate a chargeback.

Following the success of our pilot programme, the TrustPay auto-refund tool is now available to all our merchants across Europe.

If you’re looking to reduce your chargebacks and would like to know more about our auto-refund tool, get in touch with the team.