Blog

We previously shared an overview of the Visa Acquirer Monitoring Program (VAMP). In this blog, we highlight the latest updates, explain how the new calculation differs from the previous approach, and explore what these changes may mean for your business. Key Changes in VAMP To better address consumer pain points related to fraud and disputes, […]

Effective April 1, 2025, Visa is introducing enhancements to its fraud and dispute monitoring framework, consolidating existing programs into the new Visa Acquirer Monitoring Program (VAMP). As your payment partner, we want to ensure you’re fully prepared for these changes and understand how they impact your business. What’s changing? Visa is retiring the Visa Dispute […]

Secure and seamless payment processing is more critical than ever in an increasingly digital world. Network tokenization has emerged as a vital technology designed to enhance security and convenience for merchants and consumers.

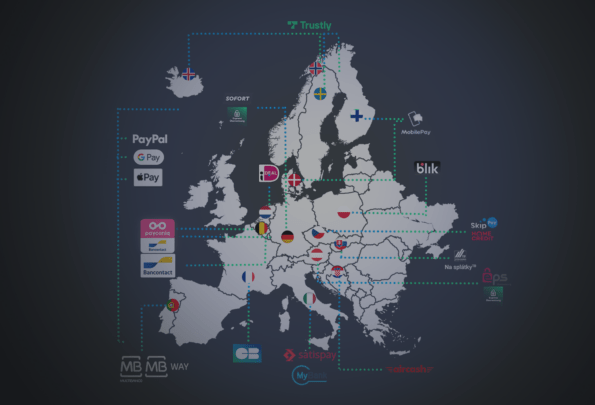

This article summarizes the presentation from the Merchant Payments Ecosystem 2024, shedding light on the evolving landscape of online transactions in Europe and the necessity of local payment methods. With our CEO, David Rintel, at the forefront, key insights into online payment trends and innovations are explored, offering a glimpse into the dynamic shifts shaping the industry.

In an era characterized by technological advancement and innovation, the financial industry is not exempt from transformation. In this rapidly evolving landscape, traditional banks face challenges from a new generation of players, the financial technology sector is undergoing swift transformations, and alternative payment methods are emerging. Open banking has been instrumental in many of these changes.

In the world of e-commerce, refunds are a necessary aspect of customer service. While no business wants to see customers dissatisfied with their products or services, offering an efficient and hassle-free refund process can enhance customer trust and satisfaction.

In today’s digital age, transferring funds has never been easier, with multiple payment methods available, including bank transfers, credit cards, and online payment services. One popular method is the SEPA Direct Debit, which offers a convenient and secure way to make recurring payments. In this blog, we’ll explore what SEPA Direct Debit is, how it works, and how to create a mandate.

The advent of technology has brought about a revolution in the world of finance, making it easier for people to carry out transactions in a more secure and convenient manner. One such innovation is the digital wallet, which has gained immense popularity in recent years.

Payment methods have come a long way over the years, especially in Europe, where digital payments have become increasingly popular. With the rise of online shopping and the pandemic-induced shift toward e-commerce, it has become crucial for businesses to offer a variety of payment options to their customers.

As online shopping becomes increasingly popular, payment methods have become essential to the e-commerce industry. In Belgium, Bancontact is the top payment method used both in-person and online, with over 17.4 million Bancontact cards in circulation, surpassing the number of Belgians.

Card-on-file (CoF) is a popular way of storing credit or debit card details to make recurring purchases easier and faster for customers. It is commonly used for subscription services and online marketplaces. While this method stores actual card information, tokenization replaces it with a unique token, making it a more secure way of storing payment details and reducing the risk of data breaches.

Chargeback allows cardholders to claim a refund from their card issuer (within set criteria and a specific timeframe). It’s given consumers decades of protection but spawned friendly fraud, especially in cardholder, not present (CNP) digital and mobile channels. 70% of all credit card fraud is through false disputes, and friendly fraud is increasing by over […]

Meet and get to know the professional and committed members of the TrustPay high-performance team.

We interviewed Kristína, Sales & Account Manager for the local market.

Faster, simpler, user-friendlier – that’s the future of authentication. People have on average 25 different accounts and use approximately 5 different passwords. If one-third of online purchases are abandoned due to forgotten passwords, what would that mean to your bottom line? The payments are finally on their way to becoming passwordless.

Depending on the location, people have various customs of paying online. Some prefer buying online with credit cards, and others use local payment methods. Offer your customers an optimal mix of them with TrustPay. Besides various options from our portfolio, we can provide you with the most popular payment method in the Netherlands: iDEAL.

Meet and get to know the professional and committed members of the TrustPay high-performance team in a new format on our blog.

We interviewed charming Miroslava Lipková, a detail-oriented Director of Operations and Quality Assurance.

One of the best ways to customize your online checkouts is using local alternative payments. In Europe’s mature markets, they’re a sure-fire way of appealing to millions of consumers especially those that are looking for safer and more convenient ways to buy online.

The boost in online sales during COVID has come with a dark underside. Both friendly and deliberate fraud has risen during the lockdown, leading to lost revenue and higher chargebacks. Walking the tightrope between managing risk and conversion optimisation is now a major headache for online retailers.

Customers demand speed and convenience from their shopping experience. The standards set by the likes of Amazon are becoming the expected norm, and merchants need to ensure their customer experience is slick to make sure they consistently convert customers and keep them coming back for more.

Across Europe, COVID lockdowns and social distancing have created a retail environment where e-commerce has thrived. All demographics, across all retail sectors, are now choosing to buy online and it’s likely that behavioural changes will stick, long after the pandemic has abated.

Merchants have to deal with a larger, more complex range of operational challenges than ever before – and the payments process is certainly no exception. Navigating growth plans, regulatory hurdles, new technologies, changing customer preferences, fraud risk, and cost control are ongoing battles for merchants of all sizes and across all sectors.

Cart abandonment is still an ongoing battle for merchants, with an alarmingly high 80% average dropout rate at the payment checkout page. It’s essential to create a smooth and seamless customer experience at the checkout to diminish the number of customers who drop out at the last minute.

As previously published in our blogs, Visa had decided to update its acceptance, disclosure and dispute policies for transactions at merchants that offer free trials or discounted introductory promotions as part of an ongoing subscription service as of 18 April 2020. The changes applied to merchants selling either physical or digital goods and services if they offered free trials or introductory offers that roll into a recurring agreement.

As we enter the final part of the year, peak shopping season, pandemic-driven e-commerce acceleration and the annual change freeze period will collide. But this year the introduction of Strong Customer Authentication (SCA) will also enter the mix – and for some merchants, it may feel like the end of 2020 will be even more daunting and difficult than the early part of the year.

Fraud is a costly and ever-growing battle for merchants. Every euro, dollar or pound of fraud now costs merchants more than three times as much in associated fees and indirect costs. Unfortunately, the cost of fraud for online merchants is often higher still.

Strong Customer Authentication (SCA) is a mandate introduced by the Payment Services Directive (PSD2) enacted by the European Commission, which requires electronic payments initiated by the buyer to be authenticated by at least two of the following three factors.