Digital wallets: What they are and how they work

The advent of technology has brought about a revolution in the world of finance, making it easier for people to carry out transactions in a more secure and convenient manner. One such innovation is the digital wallet, which has gained immense popularity in recent years.

In this blog, we will discuss what digital wallets are, how they work, the difference between digital wallets and mobile wallets, the benefits of accepting digital wallets, and the top digital wallets in the market.

What’s a digital wallet?

A digital wallet, also known as an e-wallet or virtual wallet, is an electronic device that securely stores payment card information, bank account details, and other personal information. It enables users to make payments or transactions through their mobile phones or other digital devices. A digital wallet can store multiple payment methods, such as credit cards, debit cards, and e-wallet balances, making it easy for users to switch between payment methods at their convenience.

How does a digital wallet work?

A digital wallet works by using a secure payment gateway that facilitates transactions between the buyer and the seller. The payment gateway encrypts the payment information, making it difficult for unauthorized persons to access it. To use a digital wallet, a user needs to add their payment card or bank account details to the wallet application. Once the details are added, the user can use the digital wallet to make purchases by scanning a QR code or entering the merchant’s phone number. The digital wallet securely stores the user’s payment information, eliminating the need to enter the payment details each time the user makes a transaction.

The customer then verifies the transaction with something like a password, a fingerprint, or facial recognition. The payment information is sent securely through the process of payment tokenization, and the transaction is complete.

Digital wallets vs. mobile wallets

Digital wallets and mobile wallets are often used interchangeably, but there is a slight difference between the two. While digital wallets are specifically designed to store payment information and facilitate transactions, mobile wallets are a broader category that includes apps that allow users to store tickets, loyalty cards, and other information.

Mobile wallets, like Alipay or WeChat, work only for mobile devices, such as smartphones and smartwatches.

Benefits of accepting digital wallets

Accepting digital wallets offers several benefits to merchants, such as increased security, faster transactions, and reduced costs. Digital wallets provide a secure payment method as the payment information is encrypted and stored securely, reducing the risk of fraud or theft. Digital wallets also enable faster transactions as users can pay by simply scanning a QR code or entering the merchant’s phone number, eliminating the need to handle cash or cards.

Several digital wallets are available in the market, but some of the most popular ones are GooglePay, ApplePay, WeChatPay, or PayPal.

Google Pay

Google Pay is a digital wallet developed by Google that enables users to make payments through their mobile phones. Google Pay supports multiple payment methods and offers a simple, secure payment process.

Apple Pay

Apple Pay is a digital wallet developed by Apple that allows users to make payments through their iPhone, iPad, or Apple Watch. Apple Pay uses biometric authentication to ensure secure transactions and supports multiple payment methods.

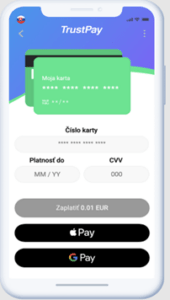

Apple Pay and Google Pay via Trustpay

WeChatPay

WeChatPay is a digital wallet developed by Chinese social media giant Tencent, allowing users to pay through their WeChat accounts. WeChatPay supports multiple payment methods and is widely used in China.

WeChat Pay via Trustpay

PayPal

PayPal‘s accounts across the world reached over 430 million by the end of 2022.

PayPal is a digital wallet that allows users to make payments through their PayPal account. PayPal supports multiple payment methods and offers a simple and secure payment process.

In conclusion, digital wallets offer a secure, convenient, and cost-effective payment solution for users and merchants alike. With the growing popularity of digital payments, digital wallets are expected to become more ubiquitous in the coming years.

Find out more about digital wallets and other local and widely used payment methods on our website www.trustpay.eu/more-payment-methods, or contact our team directly at sales@trustpay.eu.