Prevent the chargebacks with Rapid Dispute Resolution (RDR)

Prevent your business from chargebacks and disputes today. What special pre-dispute tool keeps the sellers’ chargeback ratio low? Find out more about Rapid Dispute Resolution – now available at TrustPay!

What is RDR?

Rapid Dispute Resolution (RDR) is a pre-dispute resolution tool invented by Verifi and Visa. RDR resolves your pre-dispute cases and saves you tons of time with chargeback mishaps. It’s driven by a robust decision engine and offers a quick way to solve your chargebacks before they turn into disputes.

How does RDR work?

The issuer (the bank) receives the chargeback request from the cardholder (the customer). Thanks to the RDR service and your set rules, the bank will immediately respond to the cardholder. You don’t need to communicate and bargain with your customers anymore. RDR will resolve the inquiries instead of you.

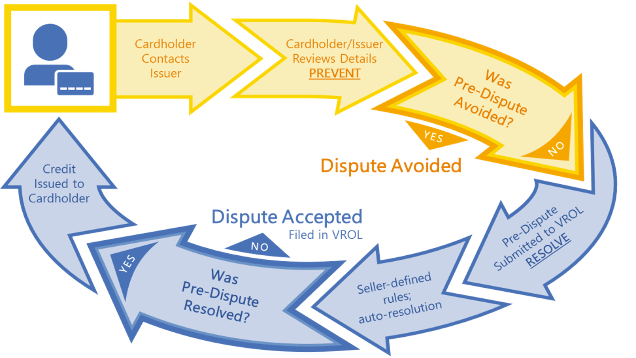

Pre-dispute flow

Depending on the rules you set, the disputes will be:

- Avoided

- Accepted

Dispute avoided

The bank reviews the inquiry details and contacts the customer back. If your RDR rules meet the customer’s chargeback inquiry, the dispute will be avoided.

Dispute accepted

When the inquiry exceeds your determined rules, it will further be documented in the Visa Resolve Online (VROL) system. The dispute will be accepted if the system evaluates the customers’ chargeback as relevant.

Resolve the disputes with correctly set rules

Business people prefer refunding customers in the pre-dispute phase instead of taking part in the unwanted phase of the dispute – with additional fees. If your rules are carefully set, resolving the disputes in RDR will help keep your chargeback ratio low. You will set your rules in the following areas:

- Transaction amount

- Dispute category

- Dispute condition code

- Personal account number BIN

- Purchase identifier

- Transaction date

- Transaction currency code

Integrate the RDR with TrustPay

Every dispute takes your time, money, and last but not least, your customers. TrustPay will help you to integrate the RDR for reaching the exact opposite. Start with RDR today and keep your business out of additional losses.

Don’t hesitate and get in touch with us at sales@trustpay.eu. We will be glad to give you more information about the tool and explain the whole process of getting it via TrustPay.